The 6-Minute Rule for Top 30 Forex Brokers

The 5-Second Trick For Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers Can Be Fun For EveryoneHow Top 30 Forex Brokers can Save You Time, Stress, and Money.Not known Factual Statements About Top 30 Forex Brokers Top 30 Forex Brokers Fundamentals ExplainedSome Ideas on Top 30 Forex Brokers You Should Know

The health and performance of a particular money are connected closely to those of the providing nation or region. Signs of economic or political chaos can trigger a counter to plummet. This is a specific risk for developing country currencies. There are multiple methods that investors can utilize to attempt and earn a profit on the forex market.Position Trading The technique of option for client investors that do not desire to continuously check the forex markets. This approach sees people hold a position for weeks, months, and potentially even years. They will certainly consider price patterns utilizing basic analysis and long-term graphes. To do well with foreign exchange trading, you need to recognize the meaning of some essential terms: A system of dimension that shows the change in value between two money The difference in between the proposal price and ask rate.

The proposal cost is typically more than the existing cost The price that an investor wants to sell an asset for. The ask cost is generally reduced than the existing rate The real cost of an asset on an exchange. The current cost on your forex trading system takes supply and need right into account which is why you might see a difference The very first currency noted in a foreign exchange set.

The 5-Minute Rule for Top 30 Forex Brokers

In the example over, the Euro is the quote currency The religion that forex is sold. One common great deal has 100,000 systems of the base money. A micro lot has 1,000 devices 7 typical pairs every one of which contain USD as the base money or counter currency with one of the following; GBP, EUR, JPY, NZD, AUD, CAD, CHF Additionally known as cross sets.

These can be really volatile A "finance" supplied by a foreign exchange firm to a retail investor. A leverage of 1:30 means that a retail financier can open a setting 30 times the size of their preliminary stake Note, some of the expressions in this forex trading lingo buster are discussed in even more detail somewhere else in this overview.

A Biased View of Top 30 Forex Brokers

1996 - 2024 OANDA Firm (http://ttlink.com/top30forexbs). All legal rights reserved. "OANDA", "fx, Trade" and OANDA's "fx" family of trademarks are had by OANDA Firm. All various other trademarks appearing on this web site are the residential property of their particular proprietors. OANDA COMPANY BELONGS TO NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EVALUATIONS.

OANDA Company is Recommended Site not celebration to any purchases in electronic assets and does not custody digital possessions in your place. All digital property deals occur on the Paxos Trust Firm exchange. Any kind of settings in electronic possessions are custodied entirely with Paxos and held in an account in your name beyond OANDA Company.

Even more Info is available utilizing the (FBS)NFA Fundamental source. (Quotex)

Indicators on Top 30 Forex Brokers You Should Know

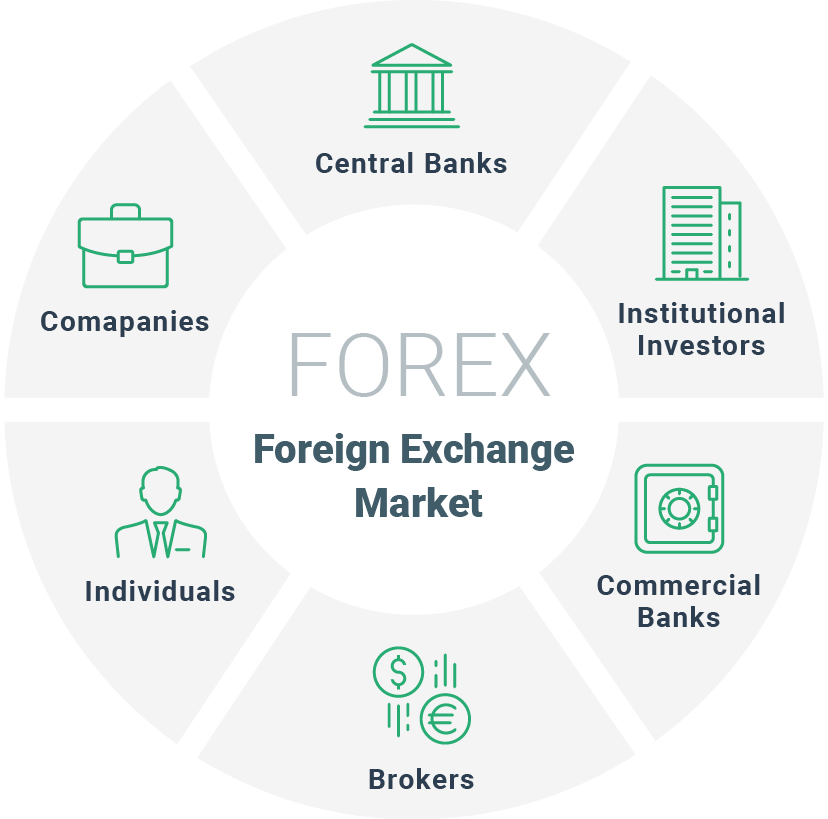

Here's where capitalists frequently get perplexed. Financial institutions are amongst the biggest gamers in the foreign exchange world. It would stand to factor that, if you trade forex, you're trading on the "interbank" network. That's much from what's actually happening. Unless you're trading upwards of a million money units per profession (at least), your purchases are most likely too tiny to be included on an interbank feed.

In order to acquire (or offer) into that market, you need to cross the bid/ask spread, so your indirect expense is 2 pips. If you're trading, state, the value of the euro versus the U.S. dollar (EUR/USD), the financial worth of one pip will rely on a minimum of 2 things: (1) Your domestic currency (whether it becomes part of the currency set you're trading or not) and (2) your placement size.

The rollover rate is the web passion return on money pairs you hold after 5 p - AVATRADE. m. ET. Bear in mind that when you go into a forex trade, you're obtaining one money to buy one more. If the rates of interest on your "long" money is more than that of your obtained money, your account will certainly be attributed based upon a favorable net interest return

Some Known Facts About Top 30 Forex Brokers.

:max_bytes(150000):strip_icc()/forex.asp-final-a13505a0ad5a4f519c7677aa151c7113.png)

National federal governments interfere in the Foreign exchange Market to stabilise their very own money or influence their economic situation. The most traded currencies are the major currency pairs, which involve the most significant economic climates in the globe.

The spread, the gap between these costs, serves as a deal cost. Spread is typically analyzed in PIPs, which stands for "Percentage in Factor" or "Rate Interest Point." A PIP represents the smallest price change in a currency set and denotes a worth modification of one unit in the final decimal factor of the rate.